ENHANCED PACKAGE

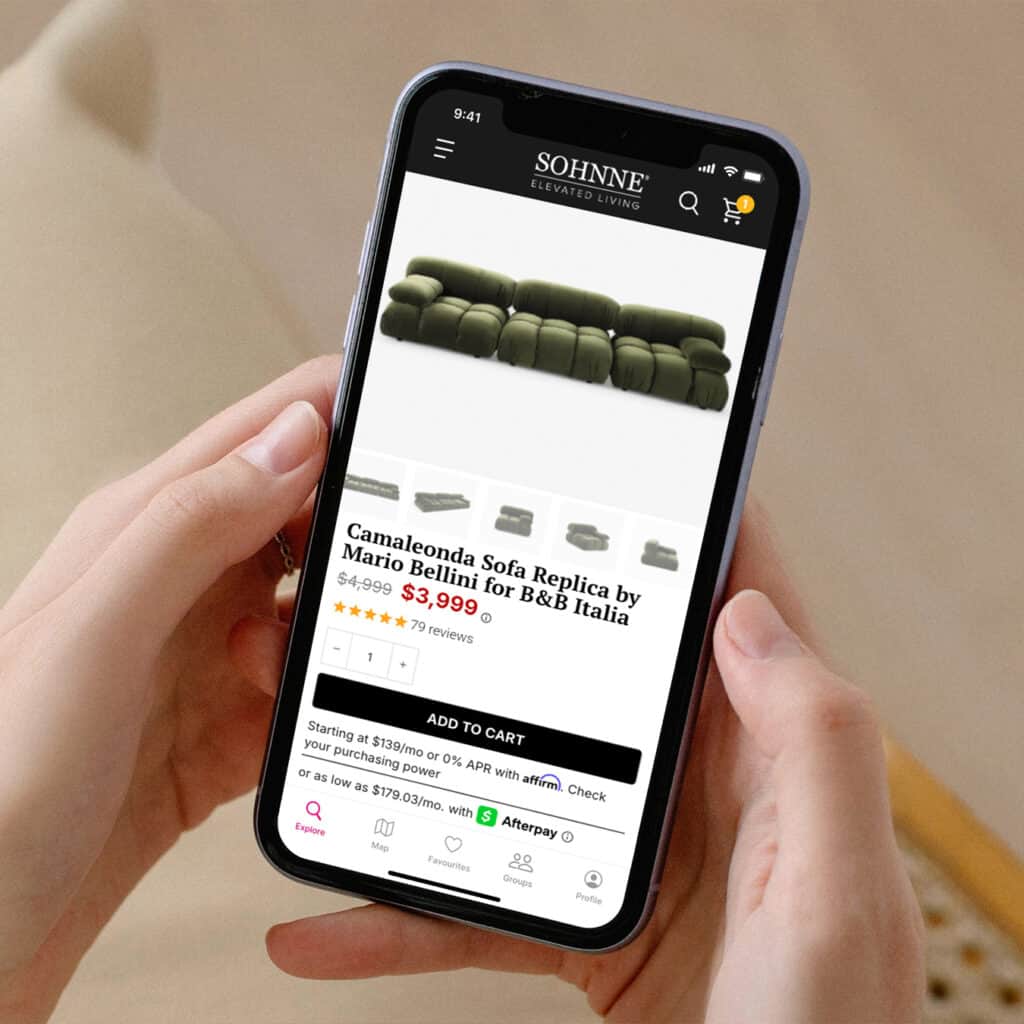

As low as 0% APR financing with Affirm for up to 12 months*

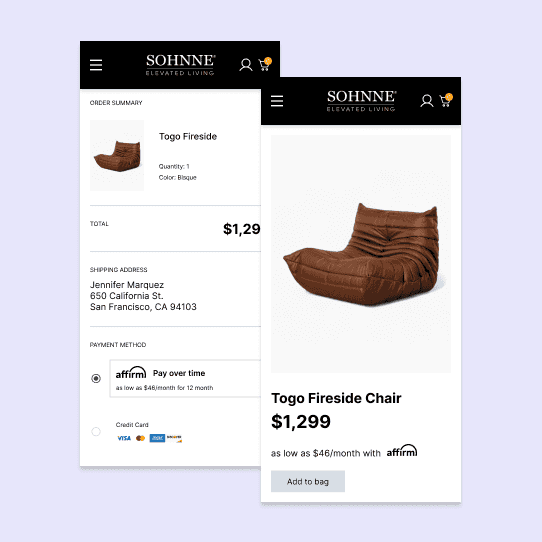

SEE IF YOU QUALIFYBuying with Affirm is Simple

*Enjoy 0% APR for up to 12 months with our Enhanced Package, or choose competitive installment rates for up to 36 months.

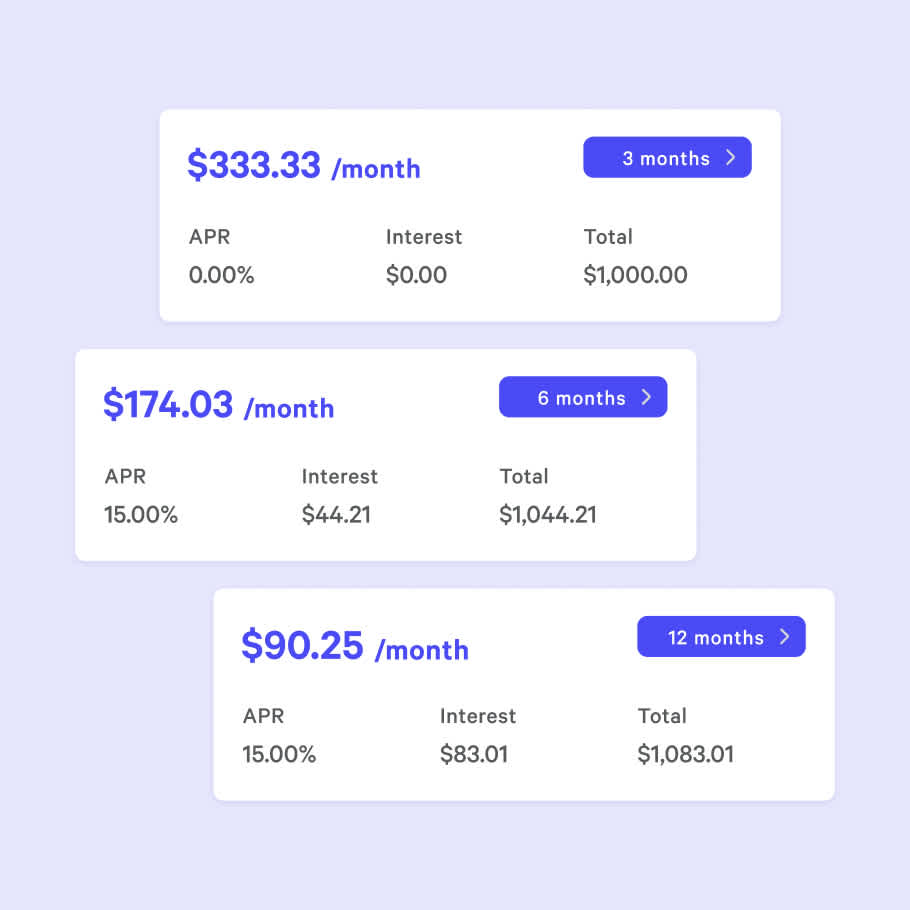

Get 0% APR financing for 3, 6, and 12 months on orders under $2,000 with Affirm

Flexible Financing on Your Terms

For Example: Our LC4 Chaise Lounge Replica by Le Corbusier for Cassina is $999 or $63 a month for 12 months at 0% APR. Plus, it ships within the US in 2–10 days, so you’ll be lounging in style in no time.

Select “Affirm” at checkout to see your exact terms. Your rate will be 0% APR or 10–36% APR based on credit approval. Payment options through Affirm are provided by their approved lending partners, and final terms (including any required down payment) depend on your credit and purchase amount. Checking eligibility won’t affect your credit score, and you’ll see exactly what you owe up front.

For more detailed information, please visit: affirm.com/lenders or affirm.com/faqs for details.

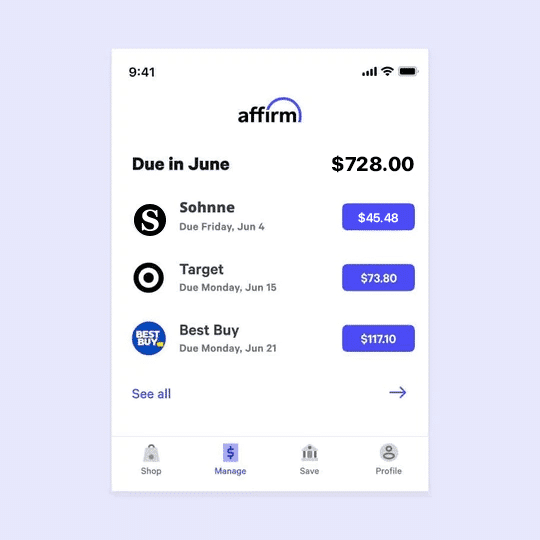

Why Choose Affirm with Sohnne?

At Sohnne, we’re committed to transparent, flexible, and fair shopping. Just like our furniture designs, your payment plan should fit your life. Financing your purchase with Affirm gives you the freedom to own high-quality pieces now, with no surprises later. Here are the key benefits of using Affirm at Sohnne:

Disclosure

If an item in your order has an extended shipping timeframe, your loan payment(s) (and any accrued interest) may be due before that item ships. Additionally, if you later receive a refund for your order, Affirm will not reimburse any interest that accumulated prior to the refund. For full details, visit affirm.com or Affirm’s FAQs for more information.